Print Checks Anytime And From Anywhere - Quickbooks - Intuit

How To Print Checks From Home? - Check Issuing

Printing your own checks enables you to personalize the checks you use and prevent running out all of a sudden. It can also be less expensive than buying your checks from the bank. However following typical bank procedures (like utilizing magnetic ink) might make printing your own checks more problem than it's worth. Get knowledgeable about the procedure, software application, and materials needed to print your checks at house, and the number of of them you require monthly or annually, so you can choose if it deserves the difficulty.

But inspect printing software does this work for you, and the software application is reasonably inexpensiveespecially if you can spread out the expense out over a high volume of checks. You might even already have what you need. Popular finance software application such as Quicken and QuickBooks make it simple to create a payment, fill out the parts of a check, and print it.

Other alternative software vendors also can assist you develop checks. For instance, the cloud-based accounting program Xero permits you to tailor a check design and add bank details in MICR format, then print the check. Inspect stock paper works with most printers and inspect printing software. It's specifically planned for printing checks, and frequently has additional security functions such as microprinting, security cautions, and watermarks.

How To Print My Own Checks - Kingwood Boost Quora

You can discover check stock paper at office supply stores or online sellers; it's more expensive than routine paper due to the security features, however the assurance they provide can be worth the cost. You can print your own consult practically any printer: inkjet, laserjet, even balanced out printers.

The only requirement is that the printer works with the magnetic ink utilized to print the MICR code. You may think about paying a check printing business to print the MICR code for you. Then you can simply drop the pre-printed checks into your own printer to add the payee, date, amount, and any memos.

You'll type your bank information, consisting of the routing number and your account number, in MICR font style at the bottom of a check. This MICR code, or MICR line, is key to the character-reading technology used by the unique computers that process checks. A perk is that these characters can also be quickly read by human beings.

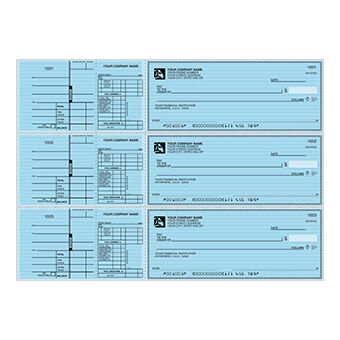

Business Checks: Custom Business Check Printing & Manual ...

Magnetic ink works in tandem with MICR innovation, enabling a computer system to check out the MICR line even if it's partially obscured by other ink or markings. Nowadays, it's not as essential to utilize magnetic ink. Mobile check deposit, for example, snaps a picture of a check to make a deposit, removing the requirement for magnetic ink.

If you just need a single check and do not want to go through the trouble of printing one yourself, your bank may be able to provide you a counter check. For example, you might require to provide a voided check for setting up direct deposit, or you might have a one-off situation that requires a paper check.

https://www.youtube.com/embed/fTTGALaRZoc

The majority of the banks today have actually upgraded scanning technology and do not require the MICR after Check21 Act. Checks are permitted to process through image OCR for faster processing. Like you deposit the check by phone and ATMs. That is the factor these days you don't get original checks any longer but a yellow replacement copy of checks which is in the same class as a legal copy of checks.